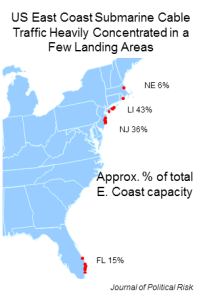

Sources: Greg’s Cable Map; Submarine Telecoms Forum, Submarine Cable Almanac (Issue 7, August 2013).

Journal of Political Risk, Vol. 1, No. 7, November 2013.

By Tom Elliott, Ph.D.

On March 27, 2013, while the technology world preoccupied itself with a sophisticated cyberattack on a spam prevention service, a low-tech assault on the Internet was taking place in shallow waters off Alexandria, Egypt. Three men with scuba gear and a fishing boat were arrested while allegedly trying to cut one of the main communications cables that links Europe to the Middle East and Africa.[1] This incident of hacking – in the most literal sense of the word – should remind us that the Internet we all rely upon depends upon physical infrastructure, much of which is easily located and relatively unprotected. Continue reading